Your financial needs in focus

18k

Happy User

Customer Support

At OceanFirst Bank, our goal is to provide secure, reliable, and innovative banking solutions that empower our customers. We aim to enhance your financial experience through personalized services, seamless digital solutions, and a commitment to trust, transparency, and excellence.

To be a trusted financial institution delivering innovative, customer-focused banking solutions. We aim to empower clients, provide secure and seamless services, and foster sustainable growth while upholding integrity and excellence.

To provide secure, reliable, and innovative banking solutions that meet the diverse needs of our customers. We are committed to delivering exceptional service, empowering financial growth, and fostering trust and long-term relationships with our clients and communities.

Comprehensive banking solutions for individuals and businesses, including checking and savings accounts, debit/credit cards, loans, mortgages, and cash management services.

Manage your accounts anytime via online and mobile platforms. Deposit and convert Bitcoin, make payments, and earn profits through Bitcoin-linked savings programs.

Tailored investment strategies and wealth management to grow your finances, combined with our commitment to community development and corporate social responsibility.

OceanFirst Bank is committed to offering competitive and transparent transaction fees, ensuring you get the best value for your banking activities. Whether it’s transfers, payments, or international transactions, we strive to keep costs low while maintaining secure and efficient services.

At OceanFirst Bank, your security is our top priority. We implement advanced encryption, multi-factor authentication, and strict data protection measures to ensure that your personal and financial information remains safe and confidential at all times.

Digital Banking Solution Est. 2002

Enjoy banking with some of the industry’s most competitive and transparent fees — saving you more on every transfer, payment, or withdrawal.

Your safety is our priority. With advanced encryption, fraud monitoring, and multi-factor authentication, we protect your money and personal data 24/7.

From business accounts to flexible loans and merchant services, we empower small businesses to grow with tailored financial solutions.

1

1

Sign up online or at any OceanFirst Bank branch. Choose from personal, business, or investment accounts.

2

2

Complete a simple verification process by submitting valid identification and documents. This ensures your account is secure and compliant with regulations.

3

3

Deposit traditional currency or Bitcoin securely. For Bitcoin, you can convert to cash or hold in your account.

Use our online and mobile banking platforms to transfer funds, pay bills, track balances, and monitor transactions 24/7.

Business Expansion Loan

Take Minimum

$10,000.00

Take Maximum

$100,000.00

Per Installment

5%

Installment Interval

90 Days

Total Installment

16

Home Improvement Loan

Take Minimum

$5,000.00

Take Maximum

$50,000.00

Per Installment

6%

Installment Interval

60 Days

Total Installment

12

Basic Personal Loan

Take Minimum

$500.00

Take Maximum

$5,000.00

Per Installment

8%

Installment Interval

30 Days

Total Installment

6

Don’t find your answer here? just send us a message for any query.

Contact with UsWe offer a full range of financial services, including personal and business banking, loans, mortgages, wealth management, and digital banking solutions.

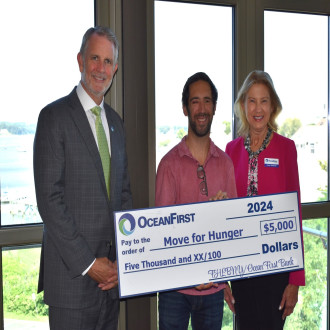

Community support is at the heart of what we do. We invest in local development programs, support education and non-profit initiatives, and encourage volunteerism among our employees to strengthen the communities we serve.

Yes. We offer tailored financial products for small businesses, including business checking accounts, commercial loans, credit lines, and advisory services to help entrepreneurs grow and succeed.

Our IPO marked a major milestone in our history, providing the capital to expand our services, strengthen our financial position, and increase our ability to support customers and communities.

OceanFirst Bank has continuously evolved, embracing technological advancements to deliver digital banking solutions while maintaining our commitment to personal service. Our strategic growth ensures we remain a reliable and forward-looking partner to our clients and communities.

Customers can open checking, savings, money market, and certificate of deposit (CD) accounts, along with retirement and investment accounts.

Yes. We strive to keep transaction fees among the lowest in the industry, ensuring cost-effective banking without compromising on service quality.

We use advanced encryption, fraud monitoring, and multi-factor authentication to safeguard your personal and financial data. Security is our top priority.

Yes. Our digital banking tools allow you to check balances, transfer funds, pay bills, deposit checks, and manage your finances anytime, anywhere.

Yes. OceanFirst Bank supports Bitcoin deposits and payments through our digital banking platform. Customers can deposit Bitcoin securely, convert it into traditional currency, and use it for banking transactions.

Yes. Eligible Bitcoin deposits may earn profit through our cryptocurrency-linked investment and savings programs. Returns vary depending on market performance and chosen investment options. Customers can monitor and withdraw profits through their OceanFirst Bank account dashboard.